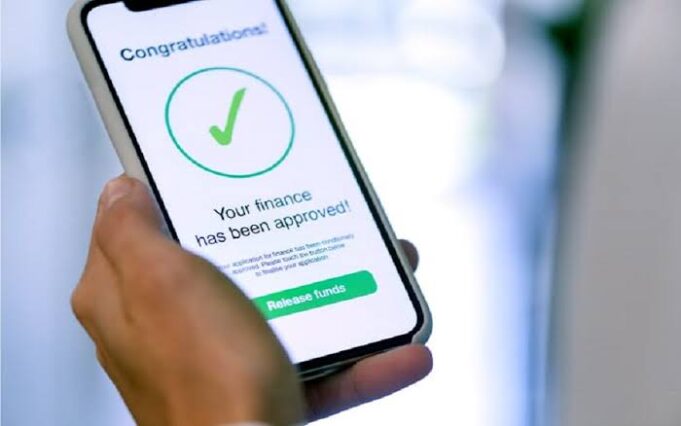

The Federal Government (FG) has delisted another 18 Digital Money Lenders (DMLs) for operating without regulatory approval.

This was made known via a statement issued by the Executive Vice Chairman of the Federal Competition and Consumer Protection Commission (FCCPC), Babatunde Irukera, on Wednesday, August 2, 2023.

Irukera said the DMLs were operating in violation of the Limited Interim Regulatory/Registration Framework and Guidelines for Digital Lending, 2022.

He noted that the commission had entered an order to Google to remove the applications from the Playstore.

Irukera said the order was also to prohibit payment gateways or services from providing or continuing services to the affected businesses.

READ ALSO: FG delists loan apps for violating registration rules

He listed the delisted DMLs to include Getloan, Joy Cash-Loan Up to 1,000,000, Camelloan, Cashlawn, Nairaloan, Eaglecash Moneytreefinance Made Easy, and Luckyloan.

Others are Personal Loan, Cashme, Easynaira Swiftcash, Crediting, Swiftkash, Hen Credit loan, Nut loan, Cash door, Cashpal, and Nairaeasy gist loan.

He said the commission would continue to engage Google to clarify how and why apps that had not received relevant regulatory approvals were available on its platform (Play store).

”DMLs are reminded that infractions or infringements may lead to permanent delisting and prohibition, as well as law enforcement action, including prosecution,” he said.

Irukera reiterated the commission’s commitment to ensuring legal and ethical operations in digital money lending.

He called on consumers to patronise only approved DMLs.

- Messi bags 5 assists, Suarez nets hat-trick as Inter Miami win in MLS - May 5, 2024

- Real Madrid win 36th LaLiga title - May 5, 2024

- 53 bag first class as Adamawa varsity graduates 5,545 students - May 5, 2024