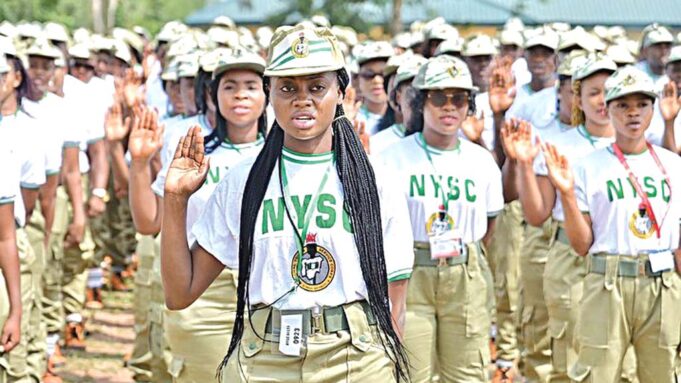

The Federal Government says the beneficiaries of the Nigeria Education Loan Fund (NELFund) will start the repayment of the loan two years after the National Youth Service Corps (NYSC) programme.

The Executive Secretary of NELFund, Dr Akintunde Sawyer, made this known in Abuja on Thursday, March 7, 2024.

Sawyer said the reason for the two-year grace after NYSC was to afford the beneficiaries enough time to get a job and be stable before the repayment.

He said: “The law provides that for students who go into paid- employment, repayment will be two years after NYSC, but, that does not mean that they cannot pay back before that time.

“However, if they don’t have a job two years after NYSC, we cannot compel them to pay. Where are they going to get the money from? So, we will help them and wait for them to be able to pay.

FG sets new date for student loan take-off

“There will be a register of those who have taken the loan and employers will have access to that register and see who has a loan.

“Once they see who has a loan, when they are employing the individual, they will be obliged through the payroll system to refund 10 per cent of the earnings of that individual back to the fund.”

Sawyer noted that the modalities of how the money would be rooted were still being worked out, adding that the employer would be obliged to make those deductions for as long as that person is at work.

“If they are yet to secure employment or if they lose their jobs they are not obliged to pay.

“We are not trying to turn applicants into criminals. We are trying to help Nigerians who need better education to get it so that they can improve their lives and the country as a whole can see improvement in its social-economic development,” the NELFund boss told NAN.

For those who might want to deliberately circumvent the process of repayment, Sawyerr said there would be a way the law would catch up with them.

He said this could be achieved whenever the defaulters have a need to access loans or any facilities from commercial banks.