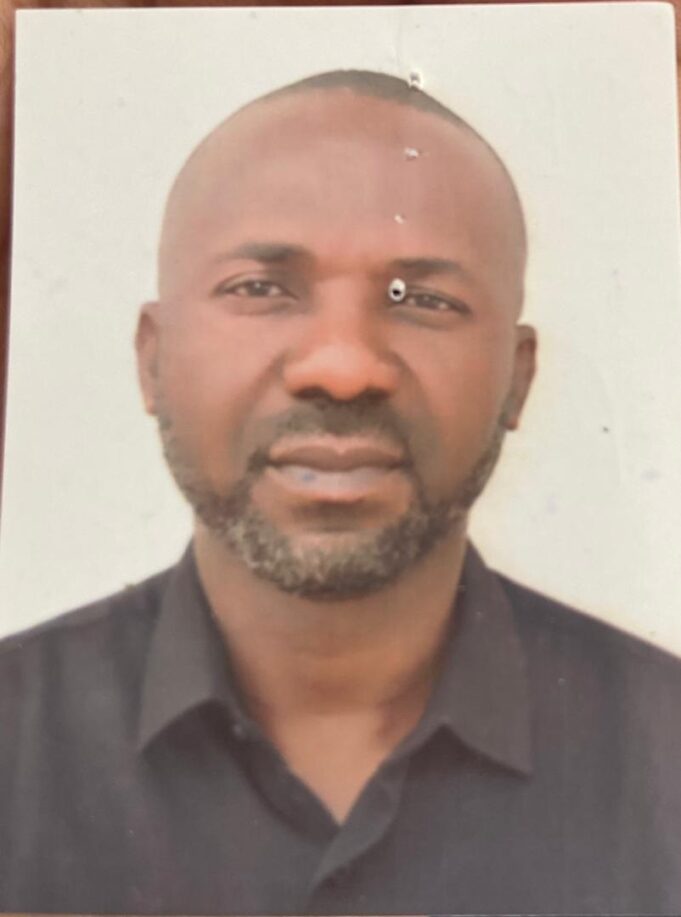

The Federal High Court sitting in Port Harcourt, Rivers State, has sentenced a former banker, Emeka Okafor, to one year imprisonment for forgery and uttering of documents.

Okafor was jailed on Tuesday after pleading guilty to two -count charges bordering on forgery and uttering of documents when arraigned by the Economic and Financial Crimes Commission (EFCC).

One of the count charges read: “That you Emeka Okafor sometime in December 2007 at Port Harcourt, Rivers State, within the jurisdiction of this honourable court while you were a staff of First City Monument Bank, with intent to defraud, did utter a forged document to wit: Re: N2,500,000.00 Investment in Bankers Acceptance dated 5/12/2007 to Donatus Ogbonna with intent that, it may be acted upon as genuine which you knew to be false and thereby committed an offence in line with Section 1 (2) (c) of the Miscellaneous Offences Act M17 of the Revised Edition (Laws of the Federation of Nigeria) Act, 2007 and punishable under Section 1 (2) of the same Act.”

The former banker, however, pleaded guilty to the two-count charges when they were read to him.

READ ALSO: 10,000 Teachers: Kaduna commences exams Oct 17

Following his pleas, the prosecution counsel, E. Abbiyesuku, prayed the court to convict and sentence the defendant as charged.

However, counsel to the defendant, Echozona Etiaba, SAN, prayed the court to temper justice with mercy stressing that Okafor is a first-time offender with no previous criminal records.

The presiding judge, Justice A. T. Mohammed, convicted and sentenced the defendant to one year imprisonment without any option of fine.

The judge also ordered the convict, in agreement with the First City Monument Bank (FCMB), to restitute to the victim the sum of N4.8 million.

Okafor’s journey to the correctional centre started when a petitioner raised a case of forgery and uttering of documents against him.

According to the EFCC, the convict committed the crimes while functioning as a Relationship Officer of the petitioner at FCMB.

“The convict diverted money meant for a fixed deposit investment by the victim and when the victim visited the bank to access his investment, he was told the convict no longer worked with the bank and that his investment did not pass through the bank channels and all the documents signed did not emanate from the bank,” the anti-graft agency stated.

- Governors: We’re reviewing sustainable minimum wage for workers - May 3, 2024

- UniAbuja ASUU faction dissociates self from strike - May 3, 2024

- Ex-PM Boris Johnson stopped from voting in UK election - May 3, 2024