The Nigeria Deposit Insurance Corporation (NDIC) has increased the maximum deposit insurance coverage for depositors of all licenced deposit-taking financial institutions in event of bank failure.

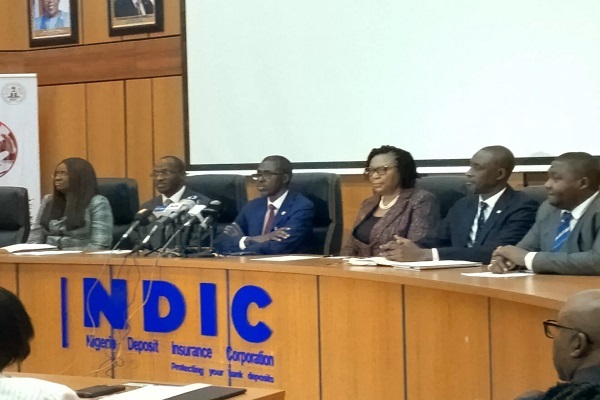

The Managing Director of NDIC, Bello Hassan, who made this known in Abuja on Thursday, May 2, 2024, said the deposit insurance coverage level for Deposit Money Banks (DMBs) was reviewed from N500,000 to N5 million.

Deposit insurance is the government’s guarantee that an account holder’s money at an insured bank is safe up to a certain amount.

Hassan said the insurance coverage for Microfinance Banks (MFBs) was increased from N200,000 to N2 million, which would provide 99.27 per cent coverage of total depositors.

He said Primary Mortgage Banks (PMBs) were increased from N500,000 to N2 million with full coverage of 99.34 per cent compared with the current 97.98 per cent.

For subscribers of Mobile Money Operators (MMOs), the NDIC boss noted that the deposit insurance coverage was increased from N500,000 to N5 million per subscriber, per MMO.

Zenith Bank shareholders approve HoldCo structure as Ovia lauds investors

Hassan said the Payment Service Banks (PSBs) insurance coverage also increased from N500,000 to N2 million.

He said the adoption of the revised maximum deposit insurance coverage would be supported by the Corporation’s funding, represented by the balances in the various Deposit Insurance Funds (DIFs) and expected annual premium collection.

Other support would be enhanced supervision to reduce the likelihood of bank failures, effective bank resolution frameworks and other funding arrangements provided by the NDIC Act.

Hassan said factors considered in the upward review of the coverage level were deposit distribution, impact of inflation, per capita Gross Domestic Product (GDP), exchange rate, and other statistical models.

The NDIC MD added: “NDIC’s mandate of Deposit Guarantee is a critical component of depositors’ protection, as it guarantees the payment of deposits up to a maximum set limit in the event of bank failure.

“The deposit guarantee covers depositors of all deposit-taking financial institutions licenced by the Central Bank of Nigeria (CBN) which include DMBs, MFBs, PMBs, Non-Interest Banks (NIBS), Payment Service Banks (PSBs), and subscribers of MMOs.

“We need to stress that the high level of uninsured deposits posed a risk of bank runs.

“This is in line with our commitment to enhancing depositors’ protection, public confidence, financial inclusion, and stability of the financial system.”

- SAHCO wins British Airways Punctuality Award - May 16, 2024

- Students injured in OAU classroom collapse - May 16, 2024

- Emirates Airlines returns to Nigeria, begins Dubai flights Oct 1 - May 16, 2024