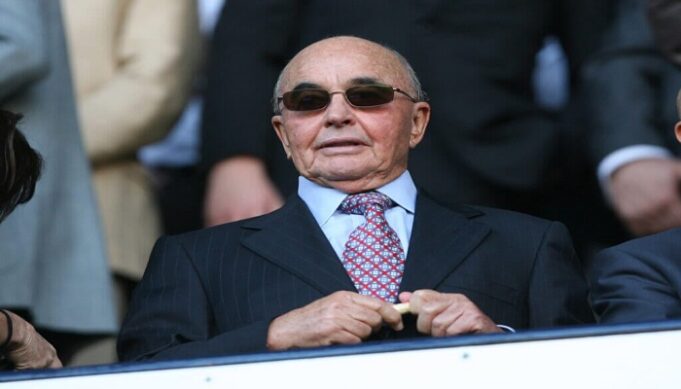

The British billionaire owner of Tottenham Hotspur, Joe Lewis, has been indicted for orchestrating a “brazen” insider trading scheme in the United States.

The U.S. attorney in Manhattan, Damian Williams, confirmed on Tuesday.

The indictment says Lewis and his associates were able to make millions of dollars using stolen information.

Lewis has been charged with 16 counts of securities fraud and three counts of conspiracy.

Lewis is accused of sharing information between 2019 and 2021 about companies, including Australian Agricultural Co., Mirati Therapeutics, and Solid Biosciences.

The indictment says Lewis used information he was given as a board member to tip off friends and associates about when to buy and sell shares.

In a video posted on messaging platform X, formerly known as Twitter, Williams said: “Today I’m announcing that my office, the southern district of New York has indicted Joe Lewis, the British billionaire, for orchestrating a brazen insider trading scheme.

READ ALSO: Transfer: Tottenham owner orders Kane sale, Saudi club offers Mbappe €200m

“We allege that for years Joe Lewis abused access to corporate board rooms and repeatedly provided inside information to his romantic partners, his personal assistants, his pilots, and his friends.

“Those folks then traded on that inside information and made millions of dollars on the stock market. Thanks to Lewis those bets were a sure thing.

“None of this was necessary. Joe Lewis is a wealthy man, but as we allege he used insider information to compensate his employees, or to shower gifts on his friends and lovers.

“That’s classic corporate corruption. It’s cheating and it’s against the law.”

Lewis’ lawyer, David Zornow, said the government had “made an egregious error in judgment in charging Mr Lewis, an 86-year-old man of impeccable integrity and prodigious accomplishment.”

He added that Lewis had come to the U.S. voluntarily to answer the “ill-conceived” charges which would be “defended vigorously in court”.

A Tottenham club spokesperson said: “This is a legal matter unconnected with the club and as such we have no comment.”

The indictment says Lewis’s girlfriend, in 2019, bought $700,000 of shares in Solid Biosciences after he told her about the results of a clinical trial.

In the same year, Lewis is accused of advising two of his pilots to sell their shares in Australian Agricultural Co. because of flooding in Queensland.

In an email to a stockbroker, one of the pilots is said to have written: “Just wish the Boss would have given us a little earlier heads up”.

The indictment says in October 2019 Lewis lent two of his pilots $1 million to buy Mirati shares. The share price went up 16.7 per cent soon after when it announced the results of a clinical trial.

The indictment says one of the pilots texted a friend: “Boss lent Marty and I $500,000 for this”.

Between 2013 and 2018 Lewis is accused of conspiring to defraud Mirati, U.S. Securities and Exchange Commission and investors by hiding his stake in Mirati using shell companies and other means.

- Tinubu: I removed fuel subsidy to stop Nigeria from bankrupt - April 28, 2024

- Tinubu to Samsung: Nigeria, best place for tech investment - April 28, 2024

- Nigeria secures $600m investment with Danish shipping coy Maersk - April 28, 2024