The Central Bank of Nigeria (CBN) has raised the interest rate from 14% to 15.5%.

This is the third increment within the last six months.

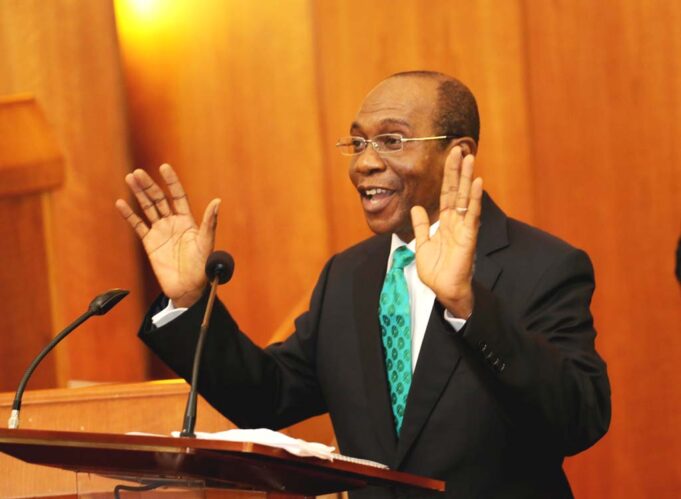

CBN Governor, Godwin Emefiele, made the announcement on Tuesday after the meeting of the apex bank’s Monetary Policy Committee (MPC).

Emefiele stated that the increment in the interest rate is to tackle the rising inflation in the country.

The MPC voted unanimously to raise the Monetary Policy Rate (MPR) and the Cash Reserve Requirement (CRR).

Ten members voted to raise the MPR by 150 basis points, one member by 100 basis points, and another member by 50 basis points.

Also, 10 members voted to increase the CRR by 500 basis points, while two members voted to increase CRR by 750 basis points.

Specifically, the MPC voted to: Raise the MPR to 15.5 per cent; Retain the asymmetric corridor of +100/-700 basis points around the MPR; Increase the CRR to a minimum of 32.5 per cent; and Retain the Liquidity Ratio at 30.0 per cent.

Atiku: Misguided youths imposing sit-at-home in South-East

In a communique issued at the end of the meeting, the CBN Governor defended the Committee’s decision.

Emefiele said: “At this meeting the focus of the MPC was on the aggressive acceleration of inflation globally and how this had begun to retard growth in both Advanced and Emerging Market Economies. Members noted that though the global economy was progressively weakening due to the various headwinds confronting the recovery.

“In Nigeria, output growth had been sustained as a result of the combination of development finance interventions by the Bank and fiscal stimulus by the Federal Government. Members noted that in the last 3 years, the CBN has injected over N9 trillion into the economy, in addition to offering 2-year moratorium for 10-year long-term loan facilities.

“The Committee believe that these interventions have significantly helped engendered growth. However, in light of the persisting pressures on inflation, the Committee encouraged the Bank maintain a close watch on the inflationary implications of the interventions.

“The MPC was concerned that within a four-month period, inflation had accelerated aggressively by 280 basis point from 17.71 per cent in May 2022 to 20.52 per cent in August 2022. The Committee was thus, of the view that given the primacy of its price and monetary stability mandate, it was expedient that significant focus must be given to taming inflation.

“The Committee was therefore of the view that a hold or loosen option was not in consideration at this meeting. This is also because a loosening will further widen the negative real interest rate gap and worsen the financial market conditions, as savings mobilization and investment inflows would decline further. It was also of the view that with the aggressive policy normalization in Advance economies, loosening the stance of policy would result in a sharp depreciation of exchange rate, leading to further hike in capital outflows.

“As regards a hold decision, this would mean a continuous deterioration in real earnings of fixed income earners and the livelihood of middle- and low-income households.

“The MPC noted that a tight policy stance would help consolidate the impact of the last two policy rate hikes, which is already reflecting in the slowing growth rate of money supply in the economy. It also felt that an aggressive rate hike would slow capital outflows and likely attract capital inflows and appreciate the naira.”

- Bricklayer jailed 8 months for stealing 12 bags of cement - May 9, 2024

- On resignation of Ihedioha, et al from PDP - May 9, 2024

- Abuja civil servant arraigns for N135m fraud - May 9, 2024